In preparation for its Eastern Partnership Summit (EaP) in December, and after drastic regional shifts, the EU is trying hard to improve its position in the South Caucasus. In this commentary for commonspace.eu, Mahammad Mammadov unpacks the EU's strategy in Georgia, Azerbaijan and Armenia, looking at what can be gleaned from its recent high-profile visits to the region and billions in newly declared financial assistance.

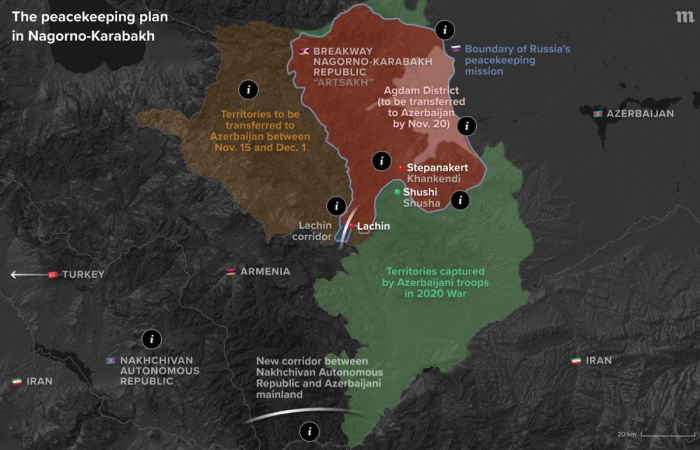

The EU has a mountain to climb to bolster the resilience of the South Caucasian republics against a myriad of internal and external challenges as the region is yet to recover from the debilitating effects of an inter-state war (Armenia and Azerbaijan) and a domestic political crisis (Georgia). According to the EU High Representative for Foreign Affairs and Security Policy, Josep Borrell, the 44-day war in and around Nagorno Karabakh in autumn 2020 altered the regional balance of power and there is a growing expectation on the side of the partner countries for the EU to take a more active stance in addressing the conflicts in the neighbourhood. Currently, Russia and Turkey are the major power brokers in the region, to the detriment of the other powers including the EU, which will need to come up with a comprehensive plan in the forthcoming Eastern Partnership summit in December to restore its credibility in the eyes of many.

The recent diplomatic exchanges between the EU and South Caucasian countries have been steps in that direction. EU officials worked in tandem with Georgian, American, and OSCE representatives to broker a deal between Armenia and Azerbaijan on June 12, resulting in a successful exchange of 15 Armenian detainees with the maps of 97,000 mines laid by the Armenian forces in the last three decades. On June 25-26, the foreign ministers of Austria, Romania, and Lithuania visited the South Caucasus on behalf of Josep Borrell, passing on his message of the EU's firm commitment to the promotion of conflict resolution and development of connectivity projects. In a blog post on July 2, Borrell claimed that the EU is “ready to help rebuild not only physical roads and bridges but also paths to reconciliation and peaceful co-existence”. On the same day, the European Commission launched a regional economic and investment plan entitled, ‘Recovery, Resilience, and Reform: Post-2020 Eastern Partnership Priorities’, to support the eastern partners’ post-COVID socio-economic recovery and long-term resilience. Building on the agenda of joint communication on ‘Eastern Partnership policy beyond 2020’, presented in March last year, the new working document offers five flagship initiatives for each South Caucasian country that aim to tailor the EU’s politico-economic engagement with the region to the specific needs of the individual partners.

It was in this context that the EU Commissioner for Neighbourhood and Enlargement, Oliver Varhelyi visited the South Caucasus on July 6-9 to discuss the new plan with his Armenian, Azerbaijani, and Georgian counterparts. It was followed by the visit of the President of the European Council Charles Michel on July 16-19 where he met the leaders of three countries to convey the EU’s idea of a peaceful and prosperous South Caucasus as part of the wider neighbourhood. Although the three countries differ in their approach to integration with the EU acquis, they are in the same camp when it comes to attracting EU investments in their local economies, hit hard by the pandemic and war. In total, Brussels aims to mobilise about €17 billion for the socio-economic recovery of the Eastern Partnership countries and €2.3 billion of that amount will be allocated in the form of grants. The new proposal is also expected to bring together investments from international financial institutions and public-private partnerships.

Georgia

In Georgia, Varhelyi reiterated the EU’s readiness to support Tbilisi’s efforts to build back better in the post-pandemic period. The new plan will bring at least €3.9 billion in investments to fund five flagship initiatives that include improving data and energy connection with the EU, transport connectivity across the Black Sea, financial support to 80,000 SMEs, digital connectivity for rural settlements, and improved air quality for over a million people in Tbilisi.

Notably, connectivity stands out as the priority area for the EU in Georgia. The country’s geostrategic location on the crossroads of the East-West transport corridors affords it a chance to emerge as a transit hub in the wider Black Sea region. The EU will invest up to €100 million to upgrade existing port and ferry/feeder services, aiming to build direct connections to Georgia in the Black Sea. Georgia has had a Deep and Comprehensive Free Trade Agreement with the EU since 2014 and the improvement of the direct links with the EU market could take bilateral trade to a whole new level. At the same time, Georgia is the only South Caucasian country with a free trade agreement with China that might provide certain opportunities for Chinese companies to use the country as a ‘springboard’ to access the EU market.

Slow and costly ferry services operating between Georgia and the EU in the Black Sea have been one of the main bottlenecks in the Middle Corridor – connecting China with the EU. To this, one may add insufficient port services that hardly balance the rail throughput on either side of the Black Sea. Currently, Bulgarian shipping companies conduct direct rail ferry services between the ports of Varna (Bulgaria), Chornomorsk (Ukraine), Poti, and Batumi (Georgia). Similarly, Georgian ports have a rail ferry connection with Constanta port in Romania but it stopped operating due to the infeasibility of trade. Container transport between Poti and Constanta continues unabated as containers’ loading is much faster and cheaper than the rail wagons. However, Georgia’s operational ferry connections with Romania, Bulgaria, and Ukraine are negatively affected by the low number of ships to service all routes, higher costs per container, and lower speed of ferries. Tbilisi’s connection with the EU in all directions across the Black Sea is in urgent need of refurbishment and Brussels’ new investment initiative may give a boost to this process by increasing the number and quality of ferry services.

Interestingly, Varhelyi did not touch upon the fate of the Anaklia deep seaport project – once the crown jewel of Georgia’s connectivity policies – with the projected ability to handle 100 million tonnes of cargo per year, many times more than Poti, Batumi, and Supsa ports jointly handled in 2018. With the extension of the Trans-European Transport Network (TEN-T) to the South Caucasian countries, Anaklia was expected to attract as much attention as the Baku-Tbilisi-Kars railroad and Alyat port in the Caspian Sea. In 2018, the Indicative TEN-T Investment Action Plan presented the port among the priority projects to be funded through public-private partnerships with a €233 million investment portfolio. Another €100 million was dedicated to the construction of a railroad to connect the port with Georgia’s railroad network. However, the project has been paused since January 2020 as the Georgian government refused to provide state guarantees for paying the loans received by Anaklia Development Consortium in case the project failed. Expectedly, it aroused speculations on what kind of role Russia played in all this as the realisation of the project would establish a new competitor for Russia’s Black Sea ports and boost the strategic rationale for Georgia’s future membership in the EU and NATO.

Azerbaijan

The EU has historically viewed Azerbaijan as a crucial partner in regional energy and connectivity co-operation. With the recent changes in the global energy and transport structures, Azerbaijan’s role as a pivotal player in these sectors has become clearer. To contribute to Baku’s efforts in this regard, the new investment plan offers five flagship initiatives containing the EU’s financial support for the green port of Baku, support to digital transport corridor, direct support for 25,000 SMEs, innovative rural development, and greener cities. In total, €140 million will be allocated for the realisation of projects. Expectedly, this number is remarkably low compared to the amount Georgia (€3.9 billion) and Armenia (€2.6 billion) will receive under this framework. According to Commissioner Varhelyi, “Azerbaijan is a prosperous country that might not need the financial assistance of the European Union and, therefore, we are having a different approach when it comes to designing the future of the economy together, and that is our assistance in knowledge and in bringing investors and creating the trade routes together with Azerbaijan”. Baku, to a large extent, embraces this approach as it has long been striving for equal partnership with the EU, moving from unilateral to a dialogical partnership. Relying on energy revenues, Azerbaijani leadership recognises its second-tier status in the EU’s conditionality based financial assistance to the EaP countries, wearing it as a “badge of honour”. However, the sheer imbalance in the recent financial help to Armenia and Azerbaijan for post-war recovery did not go down well in Baku because it is seen through the prism of Brussels’ biased approach to the situation in Karabakh. According to President Aliyev, Azerbaijan faced more economic damage than Armenia, and Brussels’ unequal assistance in this regard indicates its Armenophile position on the issue.

Strategic energy partnership has long been the building block of EU-Azerbaijani relations and both sides are interested in adapting it to the new realities of regional order. On the one hand, Azerbaijani gas exports play an essential role in the EU’s energy diversification policies which, first of all, aim to decrease dependence on Russian supplies. On the other hand, Brussels appreciates the role of Azerbaijani gas in phasing out coal energy in Europe. Baku’s direct delivery of natural gas to European markets through the Trans-Adriatic Pipeline against the background of the EU’s gradual transition to environment-friendly energy consumption adds a new tone to bilateral negotiations as the two sides have been working on the signing of a new framework agreement in the coming months.

As in the case of Georgia, connectivity was the buzzword in Varhelyi’s discussions with officials in Azerbaijan. Baku, together with Nur-Sultan, has been the main stakeholder in the development of the Trans-Caspian corridor linking the EU with the East Asian markets. Successful finalisation of the Trans-Kazakhstan railroad in 2014 and Baku-Tbilisi-Kars railroad in 2017 increased the Middle Corridor’s significance for intercontinental trade as it cut the travel distance by around 1000km. However, there remain critical gaps in connectivity through the Caspian Sea emanating mostly from the poor infrastructure and multi-modality of the transport system. Azerbaijan, Kazakhstan, and Turkmenistan have not yet achieved building sophisticated hard infrastructure capacity in the Caspian Sea to fully meet the requirements of East-West trade. Roll-on-roll-off (Ro-Ro) rail ferry services are too slow and costly, which limits the already low number of goods to be transported via the corridor. Similarly, Azerbaijan needs to strengthen its soft infrastructure capacities, which include proper technical standards, simplified customs procedures, and unified regulations with the other participating countries.

The EU has long offered its help in dealing with both hard and soft infrastructure problems in the Caspian Sea as part of its Transport Corridor Europe-Caucasus-Asia (TRACECA) program, with a permanent secretariat in Baku. 14 transport projects have been funded through the TRACECA initiative since 1995. With the TEN-T investment plan in 2018, Brussels allocated €410 million for the development of the Alyat Free Trade Zone and logistics centre in the Caspian Sea. The new flagship initiative will add €10 million for the “greening of the Alyat port to make it a sustainable hub for the smooth and accelerated movement of goods and services for trans-Caspian and other regional economic integration projects”. The flagship project on digital connectivity will attract another €10 million for the digitalisation of transport systems with a specific emphasis on better use of satellite navigation services that will reduce the cost of freight moving across the Azerbaijani territory. In January 2021, the EU launched a new Twinning project entitled, ‘Support to the State Customs Committee of the Republic of Azerbaijan in the accession to the Convention on a Common Transit Procedure, Convention on Simplification of Formalities in trade in Goods, and implementation of the New Computerised Transit System (NCTS)’, with a portfolio of up to a million euros. Against this background, Brussels’ increasing engagement with the Middle Corridor participants in general and Azerbaijan in particular might alleviate the risks associated with the unpredictability of the Trans-Caspian route and encourage Chinese rail operators and European logistics companies to use it as the shortest link in the East-West trade.

Armenia

To the surprise of many, Armenia – a member of the Russia-led Eurasian Economic Union – will receive €2.6 billion investment, surpassing the amount the associated partners (Ukraine and Moldova) will get under the new economic plan. Investments will revolve around five flagship initiatives including direct support for 30,000 SMEs, connectivity through the north-south corridor, resilience in the southern regions, digital transformation, and energy efficiency. Yerevan sees it as a reward for the democratic conduct of parliamentary elections in June. One may also interpret it as Brussels’ reminder to Russia of its presence in Armenia, even if the latter had to move further into Russia’s orbit after the Second Karabakh War.

On the Karabakh issue, the EU has always tried to keep equidistance from conflicting parties, supporting Azerbaijan’s territorial integrity while recognising Karabakh Armenians’ right to self-determination. In the post-war period, Brussels continues trying to adapt its Karabakh policy to the positions of the two countries. Charles Michel highlighted the need to address the status of Karabakh in his meeting with the Armenian prime minister, Nikol Pashinyan, while omitting the subject in his discussions with the Azerbaijani President. The neutral approach is further reiterated in the wording of the new economic plan as it uses exactly the same sentence in the Armenia and Azerbaijan sections of the document to explain the EU’s future role in the reconciliation process. Accordingly, “as soon as conditions allow, the EU is ready to support post-war recovery and conflict transformation in the Southern Caucasus including support for demining, sustainable socio-economic development in conflict-affected regions, heritage preservation, connectivity, and broader peacebuilding and reconciliation work”. So far, Brussels has mobilised €16.9 million of humanitarian aid to help people affected by the recent war.

Financial support to strengthen the southern regions’ resilience (€80 million) indicates that the EU does not want to be left out of the military-economic developments around the Syunik province, which gained geopolitical significance after Azerbaijan restored its control over the south-western borders with Armenia. Russia already deployed border guards to the area during and after the 44-day war in Karabakh. Negotiations have been underway on establishing a Russian military base in the region. Meanwhile, Azerbaijan shored up efforts to open a transport corridor connecting Baku with Nakhchivan and Turkey through Meghri in Southern Armenia. In January, leaders of Russia, Armenia, and Azerbaijan created a working group to ensure the implementation of Article 9 of the November 10 agreement that calls for Yerevan to guarantee the safety of transport links between the western regions of Azerbaijan and the Nakhchivan Autonomous Republic. Armenia drags its feet on giving access, claiming that Azerbaijan should also unblock Soviet-era railroads linking Yerevan with the neighbouring countries. In this context, Brussels has a comparative advantage over Russia and Turkey in offering its expertise on bringing long-time enmities to an end and creating a peaceful partnership through mutual economic interdependence. Although Commissioner Varhelyi avoided commenting on the issue, President Michel mentioned the crucial role regional co-operation can play in conflict resolution.

When it comes to connectivity, Armenia has been the weakest link in the EU’s engagement with the South Caucasus. Aiming to strengthen its transport infrastructure, the new investment package will dedicate €600 million to repair and construct the remaining parts of the north-south highway. The reconstruction of the Sisian-Kajaran road in the southern Syunik province features high on the agenda, involving the construction of new tunnels and bridges that is expected to cut travel time substantially. It is a remarkable follow-up to the financial help (€450 million) the EU allocated for the rehabilitation of Artashat-Agarak road under the framework of the Indicative TEN-T Action Plan. Brussels’ investments also have strategic connotations for Armenia’s emergence as a transit hub within the International North-South Transport Corridor (INSTC) connecting India with Iran and Russia via the South Caucasian routes. Iran’s plan to sign a free trade agreement with the EAEU suits Armenia’s interests in this regard, turning it into a crucial link between Persian Gulf ports and Georgian ports in the Black Sea. But it is still questionable whether the realisation of these projects in the not so close future will make Armenia a more attractive route compared to its main rival – Azerbaijan. Putting other logistical deficiencies aside, poor railroad infrastructure and Russia’s control over its railroad system makes it highly unlikely to attract investments for the further development of this route. On the contrary, Azerbaijan has been especially active in upgrading its transport infrastructure and building new roads and railways to further enable the development of the north-south corridor. Baku provided a $500 million loan to Iran for the construction of the Rasht-Astara railway that will link Iran’s railway system with Russia’s using Azerbaijani territory.

In lieu of conclusions

The EU’s newly declared financial assistance to the South Caucasian countries against the background of growing military-economic uncertainty in the region will strengthen their resilience against the domestic and external challenges. It will also reinforce Brussels’ position in the region, which was highly damaged during and after the Second Karabakh War.

Meanwhile, the EU understands that it needs to adapt the Eastern Partnership framework to the new regional realities especially after Belarus’ recent withdrawal from the program and the Associated Trio’s (Georgia, Moldova and Ukraine) repeated calls for further differentiation with a possibility of membership in the future. Internally divided on its Russia policy between the Franco-German group and anti-Russian Eastern European countries, it is less likely that Brussels will come up with a comprehensive plan to increase its security posture in the region.

With Azerbaijan, bilateral relations will be affected by developments in the EU-Turkey negotiations, especially with regard to misunderstandings in the Eastern Mediterranean. Post-war Azerbaijan views Turkey as an independent pole in the new security architecture and an essential pillar of its balancing strategy, replacing the geopolitically defunct West. In the case of Armenia, there is a unique chance for the EU to use its economic clout to facilitate its joining to the regional connectivity projects offered by Azerbaijan and Turkey but it will not change the fact that Armenia is more dependent on Russia than at any time since the collapse of the Soviet Union. Taken together, the EU might have to revise its approach to the EaP program in the upcoming summit in December, taking into account the realities on the ground.